Maak een account op Bitvavo en krijg 10 XRP gratis!

Bitvavo: Ontvang 10

XRP Welkomstbonus!

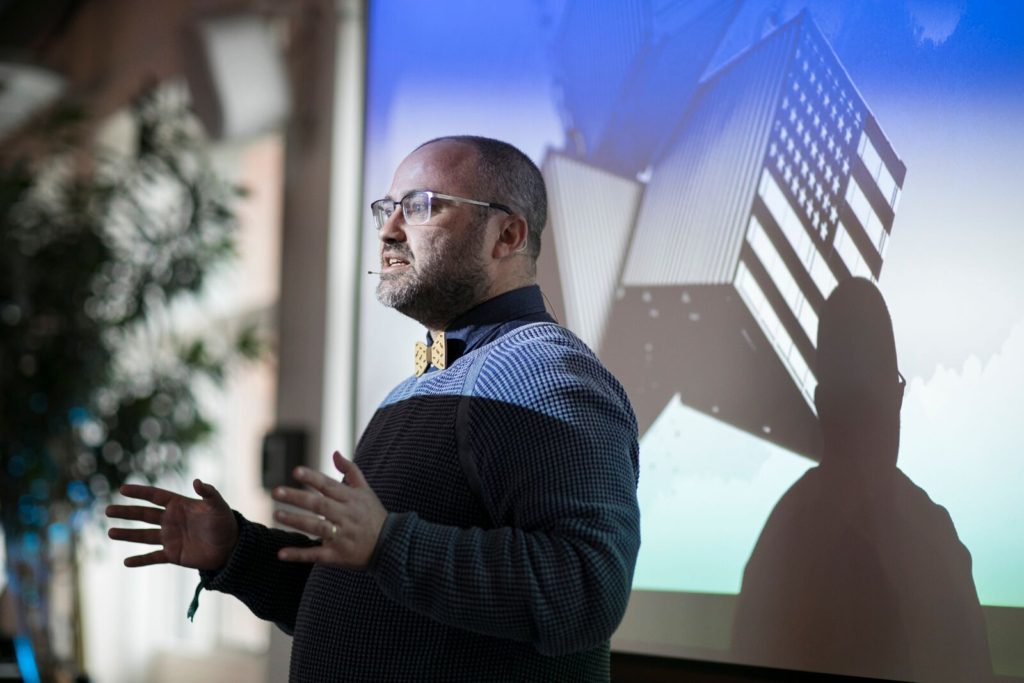

On the 16th of October, Newsbit attended the Hard Fork Summit (organized by TNW) in Amsterdam. One of the speakers at this event was Mati Greenspan, senior market analyst and portfolio manager at broker-network eToro. During the event we had the chance to ask Mati some questions about his views on recent developments in the crypto-market. The following is a report of our interview with this outspoken analyst.

After a “Market Update” of just ten minutes, Mati Greenspan’s speaking time at the Amsterdam Hard Fork Summit was over. It was short, mostly because it was an engaging talk about market developments and the economic instability we are currently facing. Lots of questions rose, with the audience as well as with us Newsbit-editors. Luckily, Newsbit had the opportunity to ask these questions in an interview with the eToro analyst.

After the speaker had taken off his microphone and found a glass of water, we began the interview and started firing questions. On the balcony in rainy Amsterdam we ask Mati how he currently looks at the Bitcoin price. “Very little volume. That’s the first thing we need to mention when looking at Bitcoin at this moment. Big price fluctuations are therefore absent. Although it is not ideal for traders when the price doesn’t move much, I think it is probably a good development for Bitcoin itself”, he states. The price volatility creates options but also imposes great risks. In these cases investors tend to wait and that’s how volumes drop. The more stable price is therefore not a bad thing, says Greenspan. “I was actually kind of happy to see the volume on Bitmex decrease because Bitmex is a great source of volatility. As a result, however, we are now seeing lots of apathy in the market.”

Mati continues to say that this development will not necessarily continue for long. “You never know what can change the momentum of the market. Especially with these low volumes, not a whole lot is needed to break that trend.” A single whale could change things completely. That’s why it is important for investors to also keep an eye on the market when situations like this occur.

“Let’s go inside. It’s starting to rain even more”, Mati says. In the conference room we find chairs and continue the conversation.

Newsbit’s research on Google Trends showed that Ripple/XRP is particularly popular in countries that have a sturdy financial infrastructure, we say. Exactly why XRP is so preferred in certain countries is unclear for the analist. According to him there are more such interesting patterns: for example, XRP gets lots of attention from female investors, he adds. Besides, XRP is also very popular among eToro-traders. “XRP is definitely one of the most traded assets on our platform, and one of the reasons why eToro has recently grown so fast.

Naturally, Ripple is a party with a whole different philosophy than Bitcoin. They particularly seek to achieve better and more streamlined international payments within the current system, Mati confirms. “They are two entirely different projects. Therefore I think it is a good deal that we’ve recently seen divergence between the XRP and BTC prices. Not good for the XRP-tokens in my portfolio of course, haha, but definitely good in the bigger picture.”

We still want to know a bit more about the Bitcoin-price, though. What effect will the upcoming halving event have on the price, according to the investor? That’s hard to tell for sure, says Greenspan. “If we look at previous halving events, we see that they can definitely have a positive impact on the value of an asset. Still, you have to be careful making predictions, because the market is completely different from when the last Bitcoin-halving took place”, he states. “By the way, I find it interesting that it will happen during the 2020 Olympics in Tokyo. Bitcoin is now a recognized means of payment in Japan, that why. I’m not sure if it has anything to do with each other, but it is definitely a funny coincidence.”

According to him it is unlikely that the upcoming reward halving is already calculated in the current price. “Nobody really knows what the exact effect on the price will be, so I don’t believe that that’s the case. It is way too hard for the market to anticipate on the halving that far in advance.” He adds that it is also a good thing that the halving will force miners to become more effective and energy-effective in their work. This way, the reward halving contributes to a more sustainable network: “We have seen recently that miners achieve a higher hash rate, using less energy resources. This is a necessary thing for the companies in order to stay profitable.” According to Greenspan, therefore, the halving will contribute to making the Bitcoin network less energy-demanding. “Only by developing cleaner and better mining methods can these mining initiatives survive.”

Mati also doesn’t belong to the group of people that is surprised by the slow start of the Bakkt platform. “I honestly thing it was odd that there were such high expectations ahead of the Bakkt launch. It seemed like people were expecting thousands of investors to be standing in line to buy Bitcoin-futures, or something. That was of course not the case, and that’s not surprising.” Clearly Mati is not taken by surprise by the little volume on Bakkt futures thus far, as opposed to many analysts and community members. New things such as Bitcoin futures need time to be accepted and integrated in the market. It is, however, a good thing that these new options to engage with the crypto-market emerge. “That, of course, goes for Bakkt as well. And for Libra, by the way.”

Meanwhile the sound system is squeakily being rolled out of the room by the organization.

Nonetheless, we still have one burning question for Mati. How does he view the institutions’ acceptance of crypto at this point? To what extent has there been progress and can we be optimistic about the coming year? “Compared to 2017 it is a whole different thing. Now we see that more and more companies and banks are looking toward crypto: much more than was the case before the bull run when Bitcoin first made the news headlines.” Investors see the large gains that crypto-investments have made. This makes many of them at least consider investing in a crypto-project. Would Mati advise large investors to do so? “For sure. It yields great opportunity if you take responsible risks.”

He gives an example of a large investment fund on Wall Street. “If you manage a yearly return of 10 to 15 percent on a portfolio, you are doing very well on Wall Street. Crypto offers the opportunity to get a return that is many times higher. Although we have seen that it can lose a lot of its value, it can also easily double or triple in price.” According to the experienced portfolio manager it is a matter of minimizing the risk.

“An investment of 2% of a portfolio in crypto offers the possibility of making 30% return instead of 15% or less. In the very worst case, this 2% loses all of its value: that’s tough luck. Even then, you end up with an 11% return on your total portfolio.” Approaching crypto-investments this way can make it an attractive option for large investors, Mati assures. “If you look at it from this perspective it’s remarkable that so few institutional investors consider crypto. There are great opportunities.”

After an energetic talk we round up the interview and shake Mati’s hand. The eToro-analyst wishes us luck working out the article. Newsbit wants to express its gratitude to Mr. Mati Greenspan for his time and elaborate responses. In addition we thank TNW for organizing the event and the interview.

Besides market analyst, Mati Greenspan is also author of “The Complete Guide to Fintech”, which deals with investing in the modern era. You can check the Guide online here.

Bitcoin verloor 46 procent aan waarde sinds oktober. Toch zijn eerdere crashes veel heviger geweest — en steeds gevolgd door herstel.

Retailbeleggers kopen massaal Bitcoin, terwijl whales juist verkopen. Dat spanningsveld kan de richting van de koers bepalen.

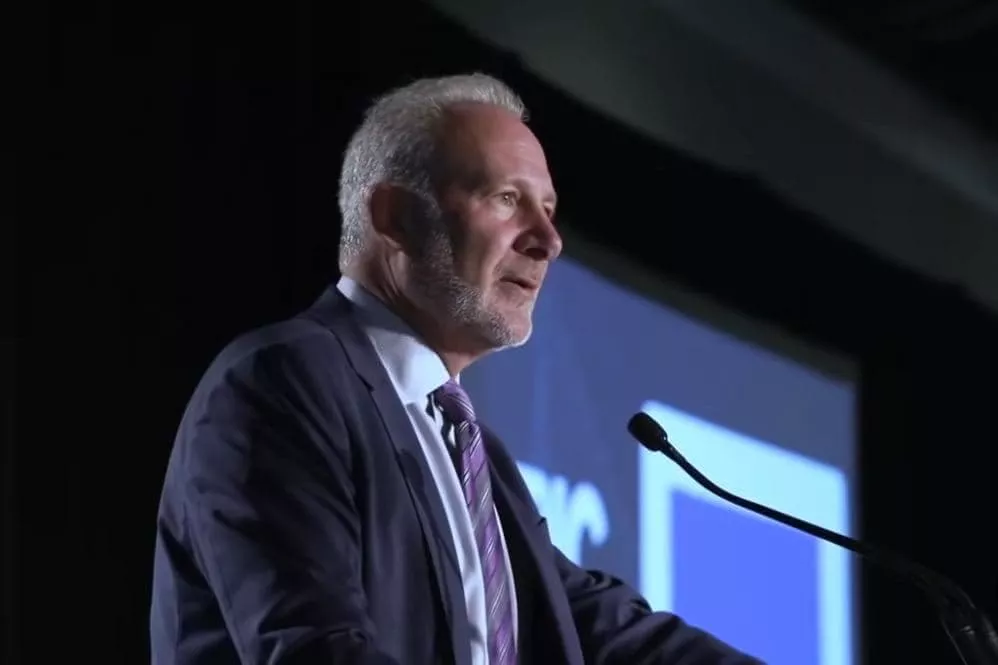

Goudliefhebber Peter Schiff verwacht een crash van Bitcoin naar het niveau van 20.000 dollar. Hoe komt hij daarbij?

WLFI stijgt hard voor het Mar-a-Lago cryptoforum. De Bitcoin koers blijft stabiel. Beleggers vrezen sell the news.

Christine Lagarde wil prikkels, geen belasting op kapitaalvlucht. De ECB opent eurosteun wereldwijd. Dit kan markten en crypto beïnvloeden.

Nederland krijgt nieuwe regels voor vermogensbelasting en dat zorgt voor een stormloop aan kritiek. Zelfs Elon Musk lacht mee.